Contents:

The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Melco Resorts & Entertainment Ltd is a Company engaged in the development and operation of resort facilities.

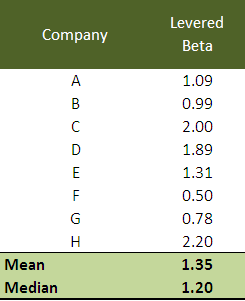

- A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

- Melco Resorts & Entertainment Limited is a developer, owner and operator of integrated entertainment resorts and casinos in Asia and Europe.

- Melco Resorts & Entertainment Limited develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

- We’d like to share more about how we work and what drives our day-to-day business.

The chart below shows how a company’s share price and consensus price target have changed over time. The lighter blue line represents the stock’s consensus price target. The even lighter blue range in the background of the two lines represents the low price target and the high price target for each stock. According to 19 analysts, the average rating for MLCO stock is “Buy.” The 12-month stock price forecast is $14.15, which is an increase of 13.29% from the latest price. Market cap, also known as market capitalization, is the total market value of a company. It’s calculated by multiplying the current market price by the total number of shares outstanding.

Stock Price Forecast

Melco Resorts & Entertainment Ltd, formerly known as Melco Crown Entertainment Limited, is based in Hong Kong. The public float for HUBC is 76.93M, and currently, short sellers hold a 0.45% ratio of that floaft. The average trading volume of HUBC on April 11, 2023 was 5.67M shares.

The stats also highlight that short interest as of Jan 12, 2023, stood at 9.78 million shares, which puts the short ratio at the time at 2.05. From this we can glean that short interest is 2.20% of company’s current outstanding shares. Notably, we see that shares short in January fall slightly given the previous month’s figure stood at 13.4 million.

Chinese stocks have been on a tear. Morgan Stanley says it’s turning even more bullish on China.

52 week high is the highest price of a stock in the past 52 weeks, or one year. Melco Resorts & Entertainment Ltd – ADR 52 week high is $14.24 as of April 11, 2023. We’d like to share more about how we work and what drives our day-to-day business.

- This shows up a 1.70% of Short Interest in company’s outstanding shares on the day.

- They suggested that in the process company could generate revenue of as low as $3.43 billion which could climb up to $3.43 billion to hit a high.

- The average analyst rating for MLCO stock from 19 stock analysts is “Buy”.

- Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade.

Sign-up to receive the latest news and ratings for Melco Resorts & Entertainment and its competitors with MarketBeat’s FREE daily newsletter. The P/E ratio of Melco Resorts & Entertainment is -6.17, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. In the past three months, Melco Resorts & Entertainment insiders have not sold or bought any company stock.

4 Wall Street research analysts have issued 1-year price targets for Melco Resorts & Entertainment’s shares. On average, they expect the company’s stock price to reach $10.75 in the next twelve months. View analysts price targets for MLCO or view top-rated stocks among Wall Street analysts. Melco Resorts & Entertainment Limited, through its subsidiaries, develops, owns, and operates casino gaming and entertainment casino resort facilities in Asia. In addition, it operates Studio City, a cinematically-themed integrated entertainment, retail, and gaming resort that comprises 280 gaming tables and 980 gaming machines in Cotai, Macau.

Our tweaks to the earnings forecast are minor; we expect adjusted EBITDA of USD 856 million in 2023. We think the shares are fairly valued as of the March 3 market close. 4 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for Melco Resorts & Entertainment in the last year. There are currently 2 hold ratings and 2 buy ratings for the stock. The consensus among Wall Street analysts is that investors should “buy” MLCO shares.

Latest On Melco Resorts & Entertainment Ltd

According to analysts’ consensus price target of $10.75, Melco Resorts & Entertainment has a forecasted downside of 13.8% from its current price of $12.47. Melco Resorts & Entertainment Ltd. engages in owning, management, and development of casino gaming and entertainment resort facilities. It operates through the Macau and Philippines geographical segments. Its businesses include City of Dreams, Altira Macau, Studio City, Mocha Clubs, Taipa Square Casino, and City of Dreams Manila. The company was founded on December 17, 2004 and is headquartered in Hong Kong.

For US and Canadian Stocks, the Overview page includes key statistics on the stock’s fundamentals, with a link to see more. Provides a general description of the business conducted by this company. Barchart is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests. Asia’s gambling markets have been hammered by COVID-19 and the zero-COVID policy in China, but that’s starting to shift.

The public float for https://1investing.in/ is 438.76M, and at present, short sellers hold a 1.73% of that float. On April 11, 2023, the average trading volume of MLCO was 3.52M shares. The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days. Melco Resorts & Entertainment Ltd – ADR 50-day moving average is $12.76. According to 19 stock analysts, the average 12-month stock price forecast for MLCO stock is $14.15, which predicts an increase of 13.29%.

The company also operates Altira Macau, a casino hotel, which has gaming tables and gaming machines; hotel rooms; dining and casual restaurants; recreation and leisure facilities; and non-gaming amenities. In addition, it operates Studio City, a cinematically themed integrated resort with gaming facilities, hotel, entertainment, retail, and food and beverage outlets in Cotai, Macau. Further, the company owns and operates seven Mocha Clubs with gaming machines, as well as Grand Dragon casino in Taipa Island, Macau. The company was formerly known as Melco Crown Entertainment Limited and changed its name to Melco Resorts & Entertainment Limited in April 2017. The company was incorporated in 2004 and is headquartered in Central, Hong Kong. Melco Resorts & Entertainment Limited is a subsidiary of Melco Leisure and Entertainment Group Limited.

The figures also indicate that as of Mar 14, 2023, number of stock’s short shares was 7.58 million which implies a short ratio of 2.5. This shows up a 1.70% of Short Interest in company’s outstanding shares on the day. In March the standing of shares short improved as it was 7.05 million in the previous month.

This means that analysts believe this stock is likely to outperform the market over the next twelve months. Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price.

Melco Resorts & Entertainment Ltd – ADR Stock Forecast, “MLCO” Share Price Prediction Charts

In addition, the how to start investing for the first time also has a majority interest in Studio City opened in October 2015. Outside Macao, Melco also owns City of Dreams Manila in Philippines, and City of Dreams Mediterranean in Cyprus. The business mix in term of adjusted EBITDA was about 84% from Macao, and the rest largely from the Philippines as of 2019’s level. Melco Resorts & Entertainment Ltd is a developer, owner and operator of casino gaming and entertainment casino resort facilities primarily in Asia.

Market capitalization is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of shares in the company outstanding by the market price of one share. The average analyst rating for MLCO stock from 19 stock analysts is “Buy”.

Futures Fall On China Concerns; Why You Should Be Cautious – Investor’s Business Daily

Futures Fall On China Concerns; Why You Should Be Cautious.

Posted: Mon, 28 Nov 2022 08:00:00 GMT [source]

When should I take profit in Melco Resorts & Entertainment stock? When should I record a loss on Melco Resorts & Entertainment stock? What are analysts’ forecasts for Melco Resorts & Entertainment stock? We forecast Melco Resorts & Entertainment stock performance using neural networks based on historical data on Melco Resorts & Entertainment stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account. To sum up, Melco Resorts & Entertainment Limited has seen a better performance recently.

Like we said, the boom is accelerating – and the time to buy EV-related tech stocks is now. A look at the daily price movement shows that the last close reads $12.73, with intraday deals fluctuated between $12.905 and $13.55. Taking into account the 52-week price action we note that the stock hit a 52-week high of $14.24 and 52-week low of $4.06. Yahoo Finance Live anchors Brad Smith, Brian Sozzi and Julie Hyman break down how casino stocks are trading on Monday morning.

To see all exchange delays and terms of use please see Barchart’s disclaimer. Melco Resorts & Entertainment has a short interest ratio (“days to cover”) of 2, which is generally considered an acceptable ratio of short interest to trading volume. Shares of some casino operators surged Monday, after Macau tentatively renewed their casino licenses, after the company pledged to make investments in attractions not related to gambling, as .

MLCO – Melco Resorts and Entertainment Ltd ADR Stock Price … – Morningstar

MLCO – Melco Resorts and Entertainment Ltd ADR Stock Price ….

Posted: Thu, 18 Jul 2019 11:51:05 GMT [source]

The receivables turnover for the company is 24.22 and the total asset turnover is 0.15. The liquidity ratio also appears to be rather interesting for investors as it stands at 1.73. Analysts like Melco Resorts & Entertainment less than other Consumer Discretionary companies. The consensus rating for Melco Resorts & Entertainment is Moderate Buy while the average consensus rating for consumer discretionary companies is Buy. Even though the stock market has performed miserably lately, and throughout most of 2022, macroeconomic data shows there is reason to be hopeful equities can rebound meaningfully sooner rather than la…